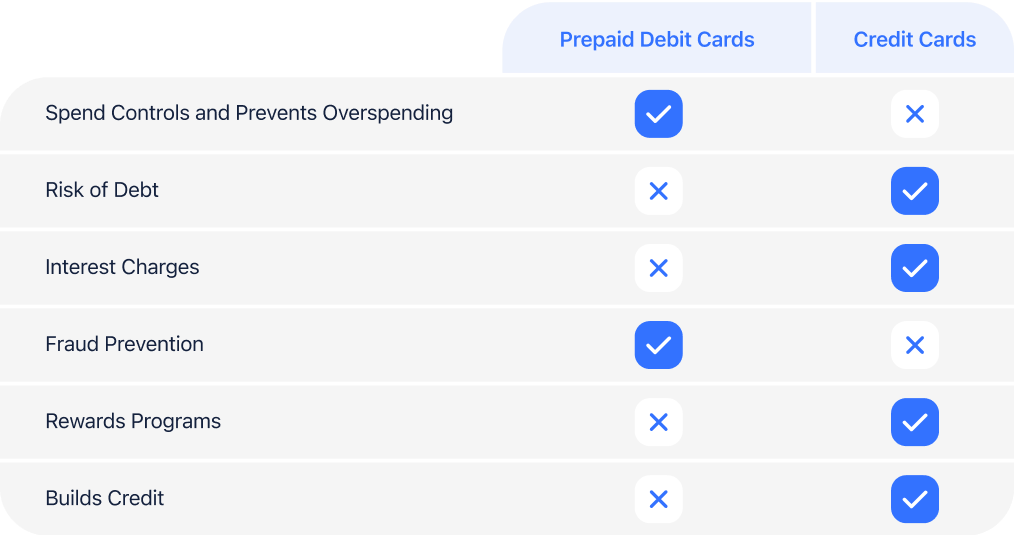

When searching for employee expense cards, business owners often encounter credit card options. Credit cards offer appealing benefits such as rewards and the convenience of spending now and paying later. However, as most of us know from personal experience, there is a downside to credit cards—namely, the risk of overspending and incurring high interest rates.

While business expenses, unlike personal ones, may come with tax benefits that make spending and credit seem attractive, it’s important to remember that spending a dollar to save fifty cents is not a viable strategy for financial success. Accumulating credit card debt is never indicative of good financial health.

To achieve long-term business success, profitability is key. While some tech startups may operate at a loss for years and eventually secure significant investments, such scenarios are rare and akin to winning the lottery. For the vast majority of businesses, the formula is straightforward: spend less than you earn.

This article will guide you on how to avoid overspending, manage expenses effectively, and ultimately, make a profit.

Why You Should Choose Prepaid Business Debit Cards

The biggest hidden cost of business credit cards is overspending, with other significant of employee spending waste, fraud and getting hit with high interest rates. Studies show that people tend to spend more when using credit cards instead of cash—up to 83% more, according to the Journal of Applied Experiment Psychology.

This disconnect between actual available funds and perceived spending power can quickly lead to overspending and cash flow issues. Business credit cards can also lead to significant financial risks, particularly through employee fraud and embezzlement.

According to a study by the Association of Certified Fraud Examiners (ACFE), businesses lose an average of 5% of their annual revenue to fraud, with a substantial portion attributed to credit card misuse. The same study found that the median loss per case of credit card fraud was $27,000, underscoring the severe impact such fraudulent activities can have on a company’s financial health.

On top of that, credit card interest rates have reached unprecedented levels, with the average rate hitting 20.1% in the first quarter of 2023, up from 14.6% a year earlier. This surge disproportionately impacts small businesses, where 70% of which use credit cards for financing.

And truth be told, the high-interest costs are straining their finances, with credit card companies earning an estimated $25 billion in additional interest revenue. This financial burden can severely affect the profitability and long-term viability of small enterprises.

So, what’s the answer? Surprisingly, it can be found in a more traditional approach.

The time-tested method for budgeting is very effective for small businesses, the envelope system.

What is The Envelope System

For decades, households have used the envelope system to manage their finances effectively. This method involves dividing cash into envelopes designated for specific spending categories.

Once the cash in an envelope is gone, spending in that category stops, ensuring strict spend management.

This system, popularized by financial advisors like Dave Ramsey, has helped countless families stay within their means and avoid debt. However, the physical envelope system can be impractical for businesses in today’s digital age.

This is where prepaid debit cards come into play, modernizing this age-old method by providing the same budgeting benefits in a digital format. This method has been adapted to the digital era by Mike Michalowicz’s “Profit First” method.

The Profit First Method: Applying Principles to Business Expenses

Mike Michalowicz’s “Profit First” method has revolutionized the way businesses manage their finances. This approach emphasizes the importance of prioritizing profit by allocating revenue into different accounts designated for specific purposes. It also mirrors the envelope method but is designed for business use.

The core aspect of this system involves having smaller pre-determined account allocations:

- Income: A general-purpose account where all business revenue is deposited.

- Profit: The account that holds the predetermined percentage of revenue your business takes off the top as profit.

- Owner’s pay: The account that holds the percentage of income used for business owners to pay themselves a salary.

- Tax: The account that holds the portion of business revenue allocated to pay taxes.

- Operational expenses (OpEx): The account that holds remaining business revenue not used for profit, owner’s pay, or taxes that’ll go towards covering business expenses.

By using the Profit First method, businesses can take control of their finances more effectively.

Prepaid debit cards can be a powerful tool in this strategy, offering real-time tracking and control over employee expenses.

This is crucial for maintaining financial discipline, particularly when you’ve defined your operating expenses. And one major outcome is that you’ll be running with a leaner budget.

So, how do you put this into practice? Profit by Paymentus has an answer.

Implementing Prepaid Debit Cards with Profit

Profit is a comprehensive financial management solution that integrates the benefits of prepaid debit cards with robust financial tools. Whether it’s allocating expenses or monitoring spending in real-time, this integration allows businesses to ensure that budgets are maintained and financial goals are met.

Features of Profit’s Prepaid Debit Card Solution

Curious how it works? Here are some of our key features that can benefit your business.

- Customizable Spending Limits: Set specific limits for each employee so no one goes over budget.

- Real-Time Tracking: Monitor expenses as they occur to gain immediate insight into spending patterns.

- Automated Receipt Collection: Profit’s system requests and collects receipts automatically, attaching them to the corresponding transactions.

- Integration with Accounting Software: Sync transactions with your accounting software for up-to-date financial records.

- Fraud Prevention: Pre-set limits and merchant code restrictions help prevent unauthorized transactions and reduce fraud risk.

Conclusion

Switching from credit cards to prepaid debit cards can significantly enhance financial control and reduce the risks associated with overspending and fraud. By adopting a modern, digital version of the envelope system through Profit, businesses can ensure real-time expense management, streamlined financial processes, and overall better financial health. Embrace the future of expense management with Profit and gain the control and visibility you need to thrive.

Whenever you’re ready, contact us and see how you can streamline your operations and save a bundle on business expenses with our finance management services.

References

Michalowicz, M. (2017). Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine. Penguin Random House. Retrieved from Mike Michalowicz.Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Journal of Applied Experimental Psychology. (2007). The Effect of Payment Coupling and Form on Spending Behavior. Retrieved from APA.

Association of Certified Fraud Examiners (ACFE). (2022). Occupational Fraud 2022: A Report to the Nations. Retrieved from ACFE.

Federal Reserve Board. (2023). Consumer Credit – G.19. Retrieved from the Federal Reserve.

National Federation of Independent Business (NFIB). (2023). New NFIB Survey: Small Businesses Rank Banking Operations and Confidence in Banking System. Retrieved from NFIB.

Ramsey, D. (2013). The Total Money Makeover: A Proven Plan for Financial Fitness. Thomas Nelson.