Common questions answered:

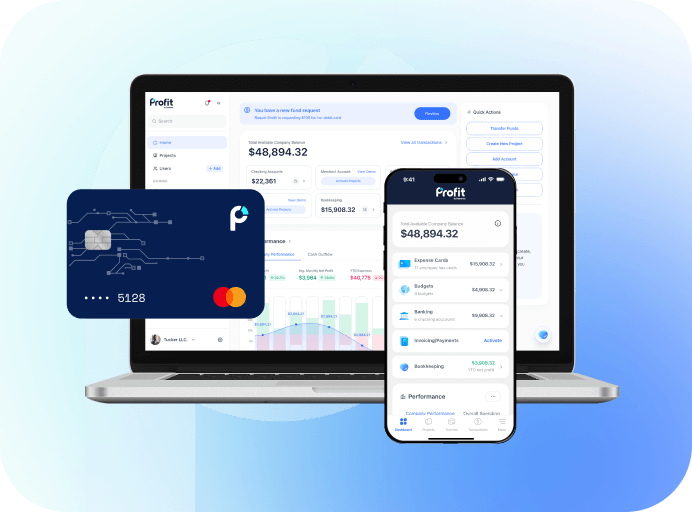

How quickly can I start using expense cards?

You can issue expense cards and start managing expenses within minutes of account approval, which typically takes about 48 hours.

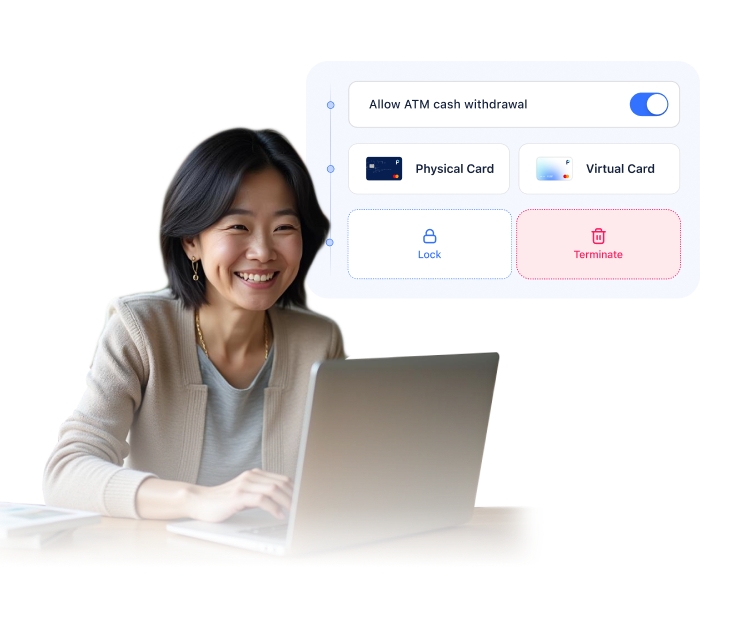

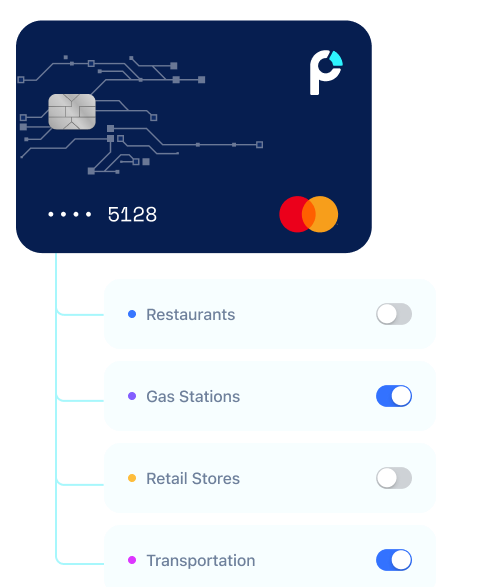

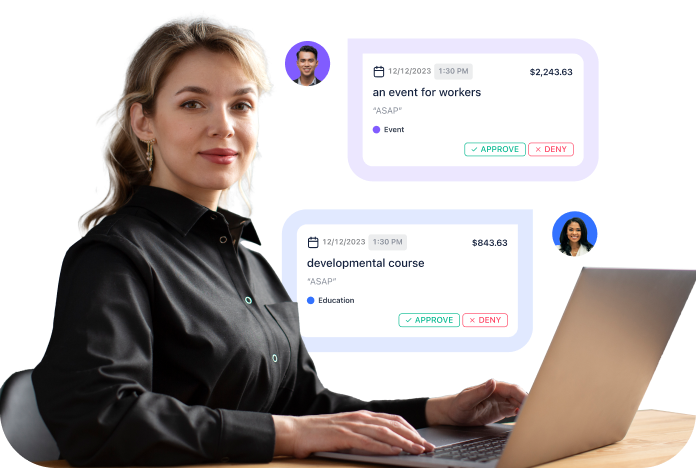

Can I customize spending rules for each employee?

Yes! Set individual spending limits, merchant restrictions, and approval settings for every team member.

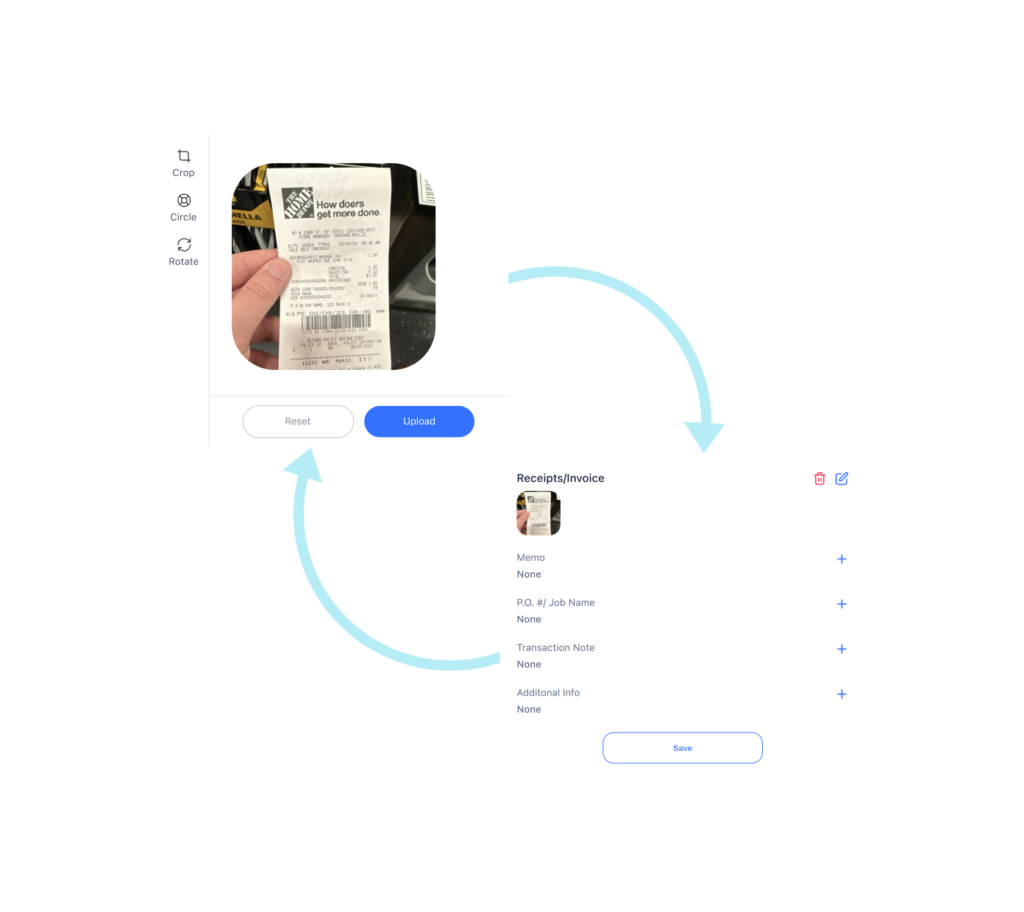

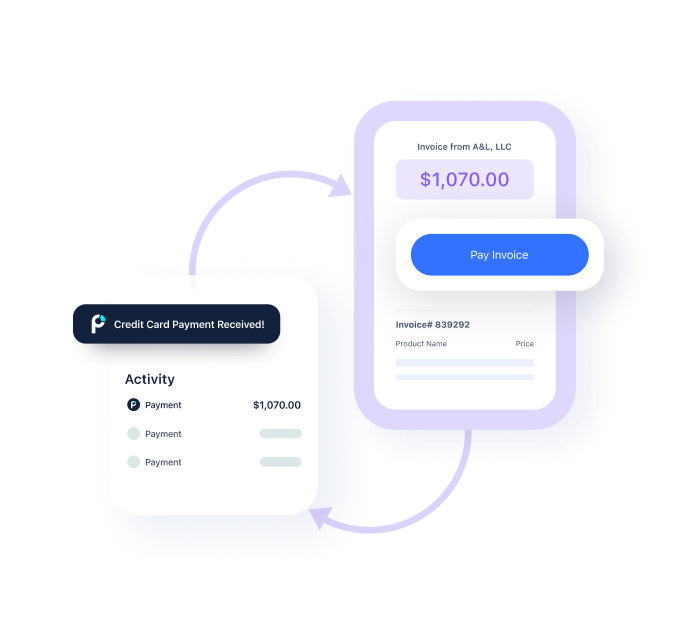

How does invoicing and payment processing work?

Invoicing is built into the system. Simply enter billing data to auto-generate pay-ready invoices and ensure timely payment processing.